Strategic focus. The Budget steers toward resilience and inclusive, innovation-led growth—prioritising green energy, AI/R&D, skills, and fiscal consolidation to broaden revenue while supporting SMEs and vulnerable groups .

Macro outlook (FY 2026/27). Real GDP growth ~4%, inflation ~3.5%, investment rate 21.2%, public-sector debt 84.8% of GDP .

Financial services & investment climate

- IFC push. New Africa strategy; dedicated licensing for wealth management & family offices; Electronic Trade Documents Bill to recognise digital trade instruments; and bullion banking added as a private-banking activity .

- Regulatory upgrades. FSC e-licensing with CKYC integration and AI assistance; AML/CFT roadmap and capacity-building ahead of the 2027 ESAAMLG evaluation .

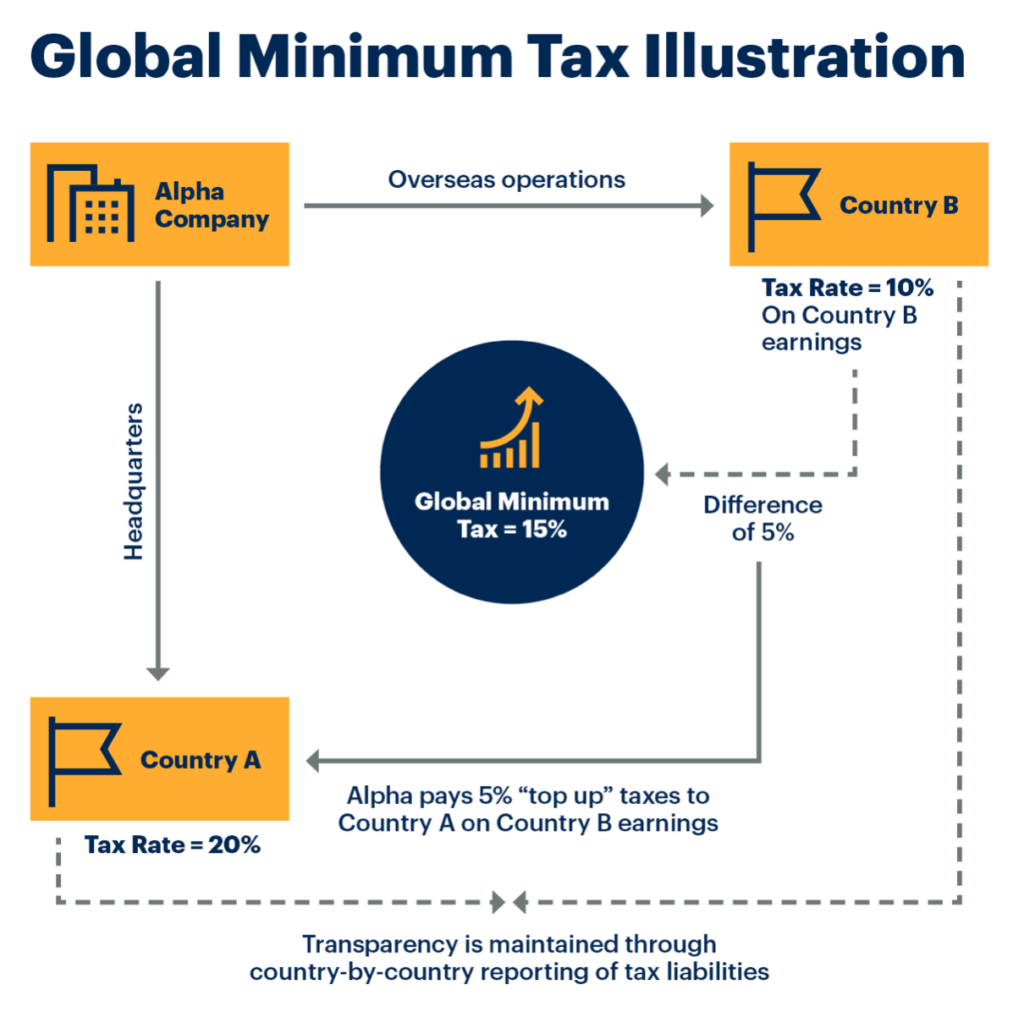

Corporate tax & international rules

- Qualified Domestic Minimum Top-Up Tax (QDMTT)—15% minimum effective rate for MNE groups (≥ EUR 750m revenue) from YA 2026/27 (competitiveness safeguards expected) .

- Alternative Minimum Tax (AMT)—applies to specific sectors (hotel, insurance, real estate, telecoms) when normal tax < 10% of book profits; not applicable to GBL companies or those with tax holidays; cannot offset with foreign tax credits .

- FinTech incentive. 80% partial exemption for licensed Virtual Asset Service Providers that meet substance conditions .

VAT & indirect taxes

- Compulsory VAT registration threshold lowered to Rs 3m turnover (from Rs 6m) from 1 Oct 2025 .

- VAT on digital/e-services supplied by foreign providers from 1 Jan 2026 (detailed rules to follow) .

- Use-in-Mauritius rule. Services supplied to a foreigner used/consumed in Mauritius become VAT-able (shift from prior zero-rating approach) .

Administration, compliance & law changes

Non-Citizens (Property Restriction) Act tweaked to allow non-residents to deal in listed securities under the Securities Act

Amnesties & settlements. One-off TDSS (100% waiver of penalties/interest for cases under appeal), VDSS for undeclared income up to YA 2024/25, and TASS waiving penalties/interest on arrears (register by 30 Nov 2025, settle by 31 Mar 2026) .

Audit window cut to 2 years for raising assessments (except exceptional cases) .

Firms earning ≥50% of turnover in FX must pay tax in foreign currency .

Companies Act updates: PIEs must issue annual reports within 6 months; new beneficial-owner declarations required (deadline 30 June 2026) .

FSA/Banking/Data Protection amendments strengthen supervision, enable certain share transfers without prior approval, align with GDPR, and broaden BoM scope (incl. FX swaps) .

Big picture

The Budget balances investment attraction with new revenue measures (QDMTT, AMT) while shielding global business from extra burdens; success will hinge on clear rules and efficient execution